So, if we return to the example of the red scarves, you would write down their value if they become much less popular, but can still be sold. But irrespective of the expense account debited, the adjustment flows into the cost of goods sold (COGS) line item of the income statement. The inventory write-off expense is a contra account paired with the inventory account on the ledger. The reserve (or allowance) account size is estimated based on historical data and internal projections. On the other hand, the corresponding credit entry is applied to the inventory account to reduce the recorded carrying value on the balance sheet.

- Even if you manage to create a reserve and it’s initially of the right size, expect management to push for a smaller reserve over time, so that they can delay the recognition of an expense into a later period.

- Hence, disposing of those obsolete inventory goods by discarding them completely may be a logical action sometimes.

- In most companies, inventory will specifically be identified as added to the reserve.

- In financial accounting, an inventory write-down becomes necessary if the market value of a company’s inventory drops below the recorded carrying value on the balance sheet.

Inventory Write-Offs vs. Inventory Write-Downs

Businesses are consequently forced to write off or write down their value or cost in their accounting records. The journal entry is debiting allowance for obsolete inventory $ 5,000 and credit inventory $ 5,000. The journal entry is debiting allowance for obsolete inventory and credit inventory. In a perpetual inventory management journal entry for obsolete inventory system, when we purchase stock, it is recognised on the balance sheet but not on the profit and loss as an expense. An inventory write-off is the process of removing inventory items from your stock on hand list. This is done when items are no longer saleable due to being damaged, spoiled, stolen or becoming otherwise obsolete.

How to Record Inventory Journal Entries

- We assume that the company does not has any provision in the past, so they have to record the inventory obsolete for the total inventory.

- If you enjoyed this article, you might also like our article on what inventory write down is or our article on what inventory valuation is.

- But suddenly, red scarves fall out of fashion completely, meaning the value of this inventory has been reduced to zero.

- After a few months, you should have a reasonable idea of the cost of this inventory.

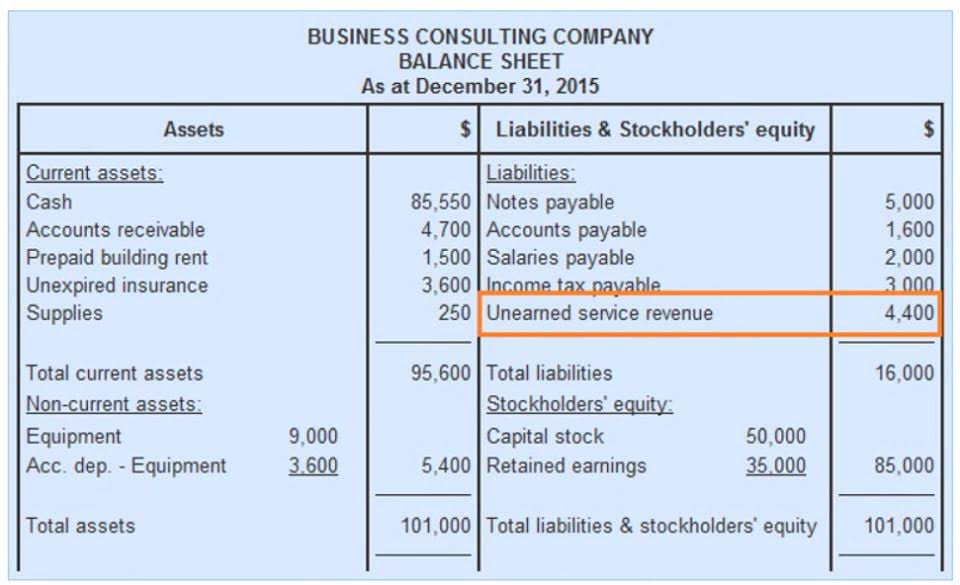

Obsolete inventory is inventory that a company still has on hand after it should have been sold. When inventory can’t be sold in the markets, it declines significantly in value and could be deemed useless to the company. To recognize the fall in value, obsolete inventory must be written-down or written-off in the financial statements in accordance with generally accepted accounting principles (GAAP). A decrease in retained earnings translates into a corresponding decrease in the shareholders’ equity section of the balance sheet. The inventory obsolescence reserve is an accounting figure used to reduce the value of the company’s inventory balance to market value.

How to Account for the Allowance of Excess & Obsolete Inventory

If we had 100 coffee mugs for sale, and we broke 5 of them, we would need to write off this stock, so we only show 95 available for sale. Without an inventory write-off, we could end up in a situation where we sell 100 but are only able to deliver 95. Finally, when you finish the product using the raw materials, you need to make another journal entry. Now, let’s say you bought $500 in raw materials on credit to create your product. Debit your Raw Materials Inventory account to show an increase in inventory. On the other hand, periodic inventory relies on a physical inventory count to determine cost of goods sold and end inventory amounts.

Writing off inventory ensures that a company’s financial records accurately reflect its actual assets. We hope this article has provided you with clear insights into how to write off inventory effectively and accurately. The first step in accounting for obsolete inventory is to identify it, Accounting Tools explains. Larger companies set up a materials review board to judge when inventory is worthless.

- It is one of the most important assets of a business operation, as it accounts for a huge percentage of a sales company’s revenues.

- However, based on the accrual basis, the expense should be allocated over time rather than recorded in only one specific period.

- By anticipating the losses from inventory write-offs, there is less of a “surprise” to investors in the event of a write-off, stabilizing the stock price of the company’s shares in the open markets.

- In fact, the intrinsic value derived by analyzing the financial statements by investors and market participants alike is more likely to be understated.

Stocktakes and inventory writes-offs

They can do this by reviewing paper records or performing a physical inspection. Yes, you can write down inventory in GAAP, and in fact, it’s required. In order to comply with generally accepted accounting principles (GAAP), businesses must follow the inventory write-down process in their bookkeeping when their inventory’s value is reduced. In conclusion, the impact of the $100k inventory write-down on the three financial statements, assuming a 30% tax rate, would be as follows. By anticipating the losses from inventory write-offs, there is less of a “surprise” to investors in the event of a write-off, stabilizing the stock price of the company’s shares in the open markets.

The result of this approach is a more rapid recognition of inventory write offs, which is a more conservative method of accounting. The amount stated in the contra account is an estimate of probable write offs, usually based on whatever historical write off percentage the company has experienced. When the actual inventory goes obsolete, the company has to quantify them in the dollar value and make the adjustment. By this time, the obsolete inventory will be disposed, so it should be removed from the balance sheet. The company has to remove the inventory and reverse the allowance for obsolete inventory.

Journal entry for disposal of obsolete inventory

Spoiled or obsolete inventory will almost always have a value that is less than cost. As such, the company must make an adjustment to bring the inventory value down to market price. Ideally, a business should maintain an obsolete inventory reserve that is paired with and offsets the inventory asset accounts.